Finance

CBN Fears Another COVID-19 Lockdown After Injecting N8.8Tr Into Economy

The Central Bank of Nigeria (CBN) is anxious over the continuous rise in the case of COVID-19 after injecting about more than N8.8 trillion into the economy since the pandemic in March 2020.

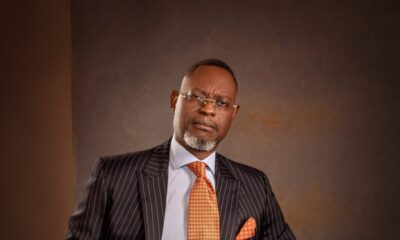

The CBN Chief Godwin Emefiele who dropped the hint in Abuja at the end of the of the first Monetary Policy Committee (MPC) meeting for the year, however warned that another round of wholesome lockdown would be “catastrophic on everybody and the economy”.

According to the apex bank boss, N6.8 trillion credit facility was given to the Federal Government to boost the fight against COVID-19.

Emefiele said the bank committed additional N2 trillion to mitigate the impact of the pandemic.

At the end of the meeting in Abuja, the bank decided to retain all its policy parameters. By an unanimous vote, the Committee decided retain the Monetary Policy Rate (MPR) at 11.5 per cent; retain the asymmetric corridor of +100/-700 basis points around the MPR; retain the Cash Reserve Ration (CRR) at 27.5 per cent; and retain the Liquidity Ratio at 30 per cent.

Emefiele said that despite the second wave of the pandemic, shutting down the economy must not be considered as a feasible option.

He said locking down the economy for the second time will have wide-ranging negative impacts, which could be more damaging to the economy and citizens.

Emefiele said the apex bank has decided to extend by 12 months again the interest rate of five per cent on its intervention facilities.

According to him, at the end of the MPC meeting, the Committee urged the CBN to sustain its current drive to improve access to credit to the private sector while exploring other complementary initiatives, in collaboration with the Federal Government, to improve funding to critical sectors of the economy.

He said the decision to extend the five per cent interest rate on CBN intervention facilities would result in losses to the apex bank but that is CBN’s contribution to ensure that interest rates particularly for interventions which are targeted to either household, SMEs, Agric and health sectors that will stimulate consumer spending remain constant.

Reacting to Fitch rating agency’s criticism of the CBN’s credit to the Federal Government, Emefiele stated that it is “very unfortunate that Fitch which is known to be a first-class company and first-class rating agency will hold such views on what we are doing and therefore pass judgement regarding the size of credit that the CBN has granted to the federal government.”

He defended the bank’s action, insisting that “the CBN is banker to government, second let it be known that the CBN is a lender of last resort not just to government but also even to our banks when they run into short term liquidity problems.”

Using other countries and the European Union as examples of entities that extended credits to their governments, Emefiele revealed that “in Nigeria just 4.5% of the GDP amounting to about $18 billion or N6.822 trillion” was extended as credit to the Federal Government to address the COVID-19 challenges.

Emefiele said some this money was used to “support measures which included outright purchase of debt by the Central banks in order to improve the ability of fiscal authorities to fund recovery efforts”.

According to him, “the efforts of the central bank are not different that’s the only thing I can say from what is being witnessed in other climes all over the world as we all share the same objective considering both conventional and unconventional measures that will support faster economic recovery in light of reduced revenue reset been faced by this fiscal recovery authorities”.

The CBN boss went on: “In the light of the on-going synchronised efforts by the monetary and fiscal authorities to mitigate the impact of the COVID-19 pandemic, the Bank has committed substantial amount of money towards this objective. Indeed, total disbursements as at January 2021, amounted to N2 trillion.