Finance

Upperlink achieves PCIDSS certification, set to re-enact retail payments across Africa

By Sandra Ani

Upperlink, a payment solution service provider (PSSP) has announced it has obtained the Payment Card Industry Data Security Standard (PCIDSS) certificate.

Through this the firm is ready to own and deploy its Payment Gateway and make it ready to service retail markets across the five African countries where it operates.

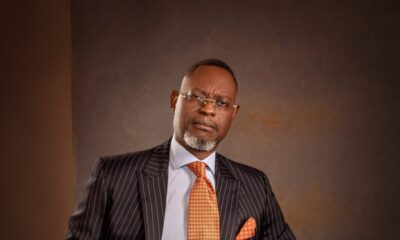

According to a statement signed by Segun Akano, the managing director and chief executive officer, the firm has been a leading aggregator with the Nigeria Inter Bank Settlement System (NIBSS), relying fully on the security and solid infrastructure of NIBSS alone.

Having stabilised its services with NIBSS which focuses on account-to-account transfers through which the firm have built enterprise applications for government and corporate institutions in Nigeria, “we intend to do more for Nigerians and other Africa countries with card payments which can address the needs of the retail markets”, Akano said.

Through Upperlink’s compliance with the rigorous PCI standard, customers using its payment services to route mission-critical applications “can be assured that their information security is maintained at the highest level and has been independently validated”, he added.

He reiterated that the PCIDSS certification is an attestation that the company’s process adhere to the international security standards in the payment industry, and that it maintains payment security which is a requirement for all entities that store, process or transmit cardholder data.

“We have embarked on this journey with customer protection and satisfaction in view. Our numerous clients are assured of the prevention of data breach, data privacy and security. With the PCIDSS, we have consolidated our position in the electronic collection and electronic payment space across the sub-Saharan Africa”, he said.

The PCIDSS is a set of industry-mandated requirements for any business that handles, processes, or stores branded cards types from the major card schemes.

It was developed to protect consumers and their data whenever and wherever they make online payments.

The security requirements is maintained by the Payment Card Industry Security Standards Council, which was founded in 2006 by American Express, Discover, JCB International, MasterCard and Visa Inc.

The standard applies to any organization that stores, transmits or accepts cardholder data.

Akano explained that by complying with the arduous requirements of PCIDSS, Upperlink provides its customers with an independent and industry-accepted security review of processes, policies, and infrastructure and software development methodology.

“We are happy and ready to serve our customers from our fully PCIDSS compliant infrastructure. The team have put in an enormous work to achieve this capability. It gives us the capacity to serve our customers excellently. It is a proof that we are providing the most secure and reliable payments services to meet their business and individual needs,” Akano said.

PCI compliance has six core objectives. These include to build and maintain a secure network, protect cardholder’s data, maintain a vulnerability management programme, implement strong access control measures, regularly monitor and test networks and maintain an information security policy.

These objectives are maintained through a set of strict regulations merchants and payment service providers must follow to collect and transfer credit card information.

Upperlink guarantees all of the set objectives to deliver.