GRBusiness

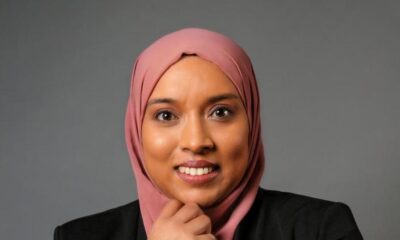

Lamide Johnson Joins the KTN Global Alliance Africa As Country Lead

This is a six-year pioneer project co-funded by the UK’s Foreign, Commonwealth and Development Office (FCDO) and Innovate UK which aims to promote job creation, inclusive growth and poverty reduction through knowledge sharing, skills building and opportunities to support businesses and innovations that can deliver scalable impact.

While speaking to Lamide about this appointment, Lamide said, “Joining the KTN Global Alliance Africa Programme is not only a strategic career move, but throughout my work with entrepreneurs and innovators in the past decade, I have found that partnerships leveraged by communities are the fastest way to build economic prosperity in Africa – this largely informed my decision to join the KTN. I am excited about the work we’d do to support the development of Nigeria through partnerships, innovation and technology.”

Prior to joining KTN, his most recent appointment was as the Deputy Director at the UK-Nigeria Tech Hub, an initiative by the UK government’s Department for Digital, Culture, Media, and Sports (DCMS), where he was also Interim Country Director. Lamide led the design and implementation of high impact initiatives and programmes including the COVID-19 Impact Survey; Nigeria’s first Intelligence Platform for Technology & Innovation in Nigeria; the iNOVO Acceleration Programme; the Future Females Business School Programme; the Developer Placement Programme; the Innovative Teachers Fellowship Programme; the African Angel Academy, amongst other programmes. You can see the UK-Nigeria Tech Hub 2020 Impact Report here.

Lamide is also an ex-Ventures Platform staff member, where he served as the Chief of Staff to Kola Aina, and also as the Director of Partnerships and Engagement from May 2017 to March 2020.

With over 10 years of experience, designing, developing and implementing digital skills, entrepreneurship, investment readiness, policy and capacity building programs for startups and entrepreneurs creating solutions for Africa’s urgent problems, that promote job creation and provides access for communities, Lamide has undoubtedly been committed to accelerating innovation in Africa.

He is a Mandela Washington Fellow, also a Bill and Melinda Gates Foundation Goalkeeper. He is trained in Business and Entrepreneurship from Kellogg School of Management, Northwestern University, Illinois, USA; and he also has a Master of Business Administration degree.

Aside from his passion in designing digital skills, policy and innovation programmes in Africa, ‘Lamide is a Storyteller and Author. He is the Founder and Lead Faculty of The Storytellers Academy, where he teaches the art of compelling storytelling for African startups, brands, businesses, & social enterprises; nurturing young creative minds to tell the African story and connecting them to the vast opportunities in the content creation market.

He has authored four books, and his fifth book is due to be launched in December, 2021.

-

Education2 days ago

Education2 days agoEducation Priorities to Help Young People Shape Africa’s Future

-

Education2 days ago

Education2 days agoDigital Transformation Expert Rock Adote Joins Madonna University Board of Trustees

-

Health2 days ago

Health2 days agoHealthcare Under Attack: Why Cybersecurity is Now Critical Care

-

Health24 hours ago

Health24 hours agoCustos Care Foundation Reaches Thousands of Women, Girls with Free Medical Outreach