GRTech

African Payroll & HR Management Company Bento Expands to Ghana, Kenya & Rwanda

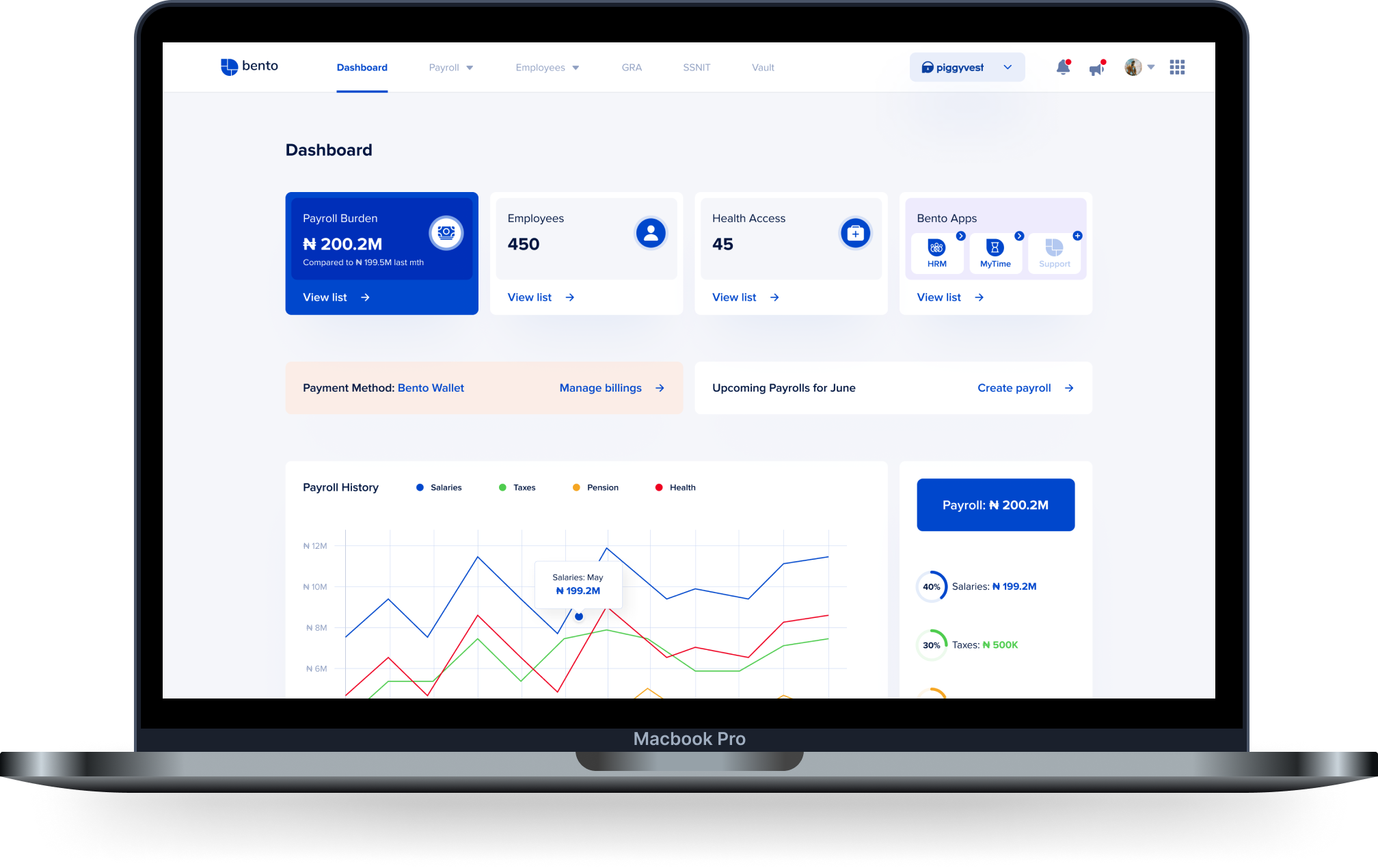

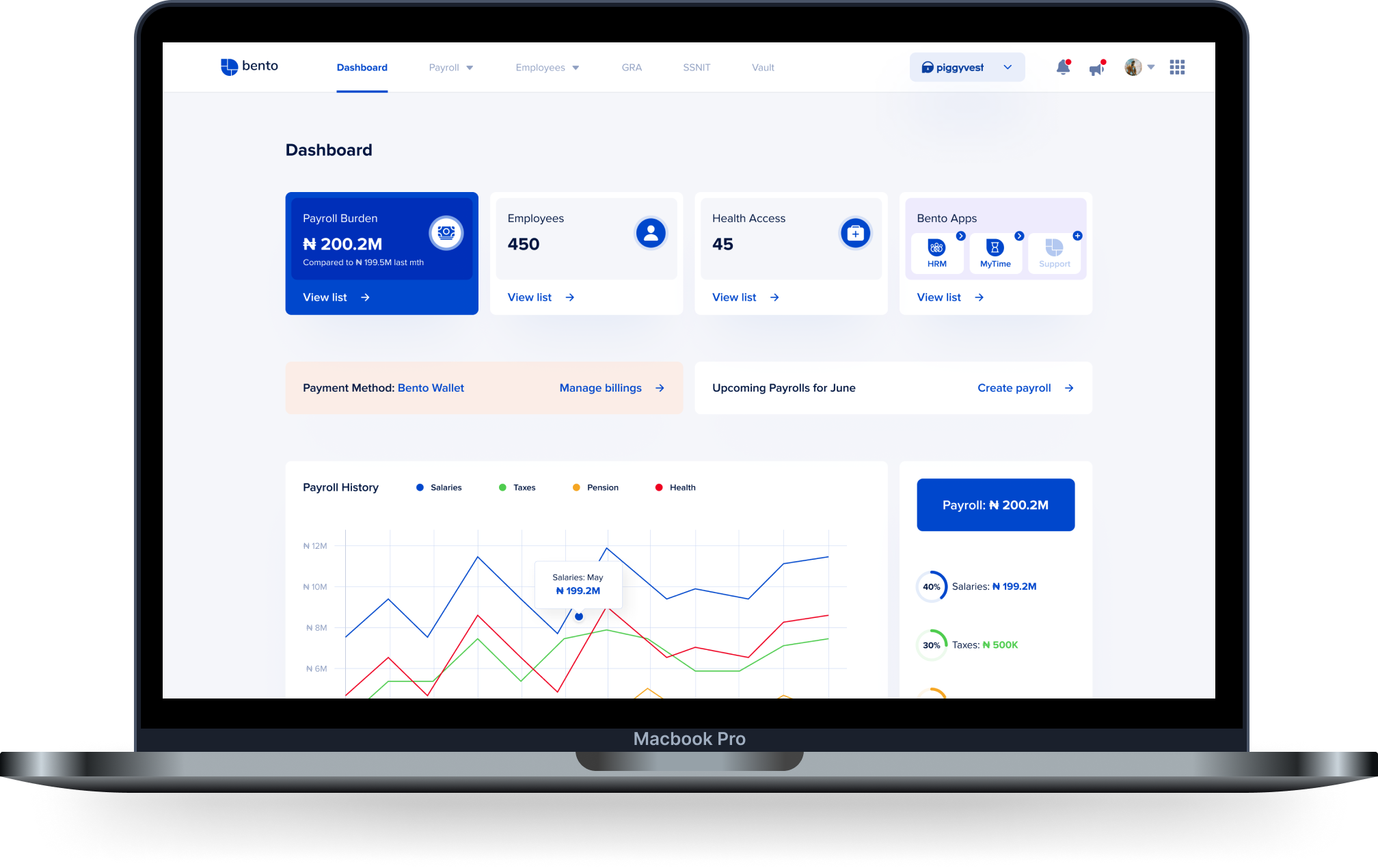

Bento, a pan-African digital payroll and HR Management (HRM) platform, has today announced its launch into three new markets, establishing a presence in Ghana, Kenya and Rwanda to grow the company’s reach across the continent.

The payroll and HR Management market in Africa is a huge untapped opportunity with over 400 million people in the labour force. African businesses have remained largely analogue up until now, using spreadsheets and bulk upload on bank portals, bank transfers, cheques, and even cash. Bento is bringing African payroll and HRM into the digital age and ensuring that different market participants are communicating and leveraging data to help unlock credit solutions.

Founded in Nigeria in 2019, Bento addresses many of the challenges African businesses face by automating salary payments, tax, pensions and other statutory remittances. Through its cloud-based platform, Bento empowers African businesses and gives them peace of mind by streamlining many of their processes with a single click. For employees, the platform offers access to third-party services such as credit solutions – which include the ability to pay school fees and rent monthly rather than yearly – unemployment insurance, savings, investments and much more, all at no cost to employers.

Having obtained full operating licenses in each market, Bento is building local teams in Ghana, Kenya and Rwanda and will adapt its products for local cultural and financial nuances. In Nigeria, Bento has stood at the forefront of payroll and HRM, serving over 900 active Nigerian businesses across all sectors, including some of the largest Healthcare and Financial Services companies in the country such as Hygeia and Tangerine Africa, as well as many Y Combinator-backed firms including Paystack, Kobo360, Branch, Helium Health, and LORI Systems.

The company is targeting further rapid growth across the continent, and will launch in Egypt, South Africa, Uganda, Tanzania, Angola and Senegal by the end of 2022.

”Seeing so many companies using analogue methods to manage their workforce is simultaneously frustrating and exciting for us. Employers don’t have access to locally customised, world-class payroll and HRM tools, and employees can’t easily access third-party services to help make life easier,” said Ebun Okubanjo, Co-Founder and CEO at Bento. “When you think about it, your salary powers your life, so we’re building the operating system that will have a profound impact on the African continent for generations to come.”

While solving the missing piece of the B2B payroll and HRM puzzle, Bento is also enabling employees to access credit solutions and other third party products and services. Around 95% of African consumers have never had access to formal credit and rely on informal lenders and savings schemes. To further illustrate this point, in Africa on average 4.5% of people have access to a credit card compared with 65% in the US. Bento’s proprietary credit engine, built in partnership with Tarya, Israel’s largest P2P lending firm, ensures the company can offer significantly better rates than traditional retail lenders and disburse within minutes rather than days.

“We’re starting with payroll and HRM, but moving rapidly towards Salary 2.0, where we redefine the intersection of work and life and transform the way people earn, spend and borrow on the continent,” added Chidozie David Okonkwo, Co-Founder and COO at Bento. “Having successfully established product-market fit in Nigeria, one of the most difficult markets to penetrate in Africa, we’re excited to roll out across the continent and solve the real problems we know millions of employers and employees face on a daily basis.”

Bento can be accessed by employers through its secure, cloud-based web platform and through its mobile app for employees, available on the iOS App Store and Google Play.

-

GRPolitics5 days ago

GRPolitics5 days agoNULGE, Stakeholders Endorse Mbah, Reaffirm 2027 Support as Tomorrow Is Here Movement Inaugurates Coordinators

-

GRTech5 days ago

GRTech5 days agoFDI: Enugu Govt, Haier Group Launch $20m Factory, set for $30m expansion

-

News4 days ago

News4 days ago‘You escape, or you die’: African men say Russia duped them into fighting in Ukraine

-

Spotlight5 days ago

Spotlight5 days agoOgbuefi Remmy Nweke Takes Helm as Organization Ushers in New Era