Finance

How N20trillion Stamp Duty Revenue Disappeared From Federation Account

Information about the revenues from stamp duties in the last 3 years estimated at N20 trillion disappears as the federal agencies involved in the collection have refused to provide information, despite the Freedom of Information (FOI) request filed by The ICIR.

The FOI requests were sent on July 31 on behalf of LeaksNG to the Central Bank of Nigeria (CBN), Office of the Secretary to the Government of the Federation (OSGF), Nigerian Postal Service (NIPOST), and the Nigeria Inter-Bank Settlement System (NIBSS) PLC.

Information requested for include a report of stamp duty remittances by Deposit Money Banks and other financial institutions, the current status of the Stamp Duty Central Account domiciled in the CBN, stamp duty revenue remitted to the CBN by NIBSS between 2016 and 2017, amount of revenue collected by NIPOST between 2010 and 2016 and so on.

Two months after the requests were dispatched, on September 26, letters of reminder were again sent to the various offices to draw their attention to the enquiry.

Nevertheless, till the time of this report, none of the institutions has fulfilled its legal obligations by providing the information asked for.

While NIPOST and NIBSS have not bothered to respond at all, others gave one excuse or the other for their inability to oblige.

Different Reasons, Same Conclusion

Of all the five agencies that received enquiries from the ICIR, three responded, but sidestepped the responsibility to disclose information.

The OSGF, in its reply dated August 9, 2018, said it had referred the FOI application to the Federal Inland Revenue Service (FIRS), which according to it is better positioned to provide answers.

“After a careful review of the application,” wrote J.O. Obule, Acting Legal Adviser to the Secretary, “the Office is of the view that the Federal Inland Revenue Service (FIRS) has a greater interest and is the custodian of the information sought and therefore would be in a better position to provide same.

“Please be informed that your application has been referred to the FIRS accordingly and you are advised to deal with it directly,” he added.

FIRS would later shift responsibility to Nigerian Postal Service, NIPOST

In a letter dated November 5 and signed by Ike Odume, its Director of Legal Services, the FIRS wrote:

“The Legal Service Department of the FIRS received a letter from the International Centre for Investigative Reporting dated 26th September 2018 requesting for details for Stamp Duties recovered from NIPOST. We regret to inform you that FIRS does not collect Stamp Duties from NIPOST.

“Therefore we ask that the above request be directed to NIPOST.”

NIPOST is yet to respond to similar enquiries sent to them.

Finally, the Central Bank of Nigeria replied to The ICIR‘s request on November 6 and, in the letter signed by R.J. Monguno of the Corporate Secretariat, it said it cannot provide the information sought as the matter is the subject “of a suit before the Supreme Court of Nigeria and is therefore subjudice”.

The court action referenced in this letter is yet unclear.

The status of unremitted revenue from stamp duties said to have run into several trillions of naira over the years, has been shrouded in secrecy.

In November 2017, the Senate kick-started a probe into the allegation that stamp duties revenue which accumulated over a period of five years and is valued at over N20 trillion has not been paid into the federation account.

Following a motion raised by John Enoh, the senator representing Cross River Central district, the Senate had instructed committees on finance and banking, insurance and other financial institutions to investigate the scandal and report back to it within a period of eight weeks.

“The Senate is worried that the provision for stamp duty in the revenue framework of the nation’s annual budget for 2015, 2016 and 2017 has been N8.7 billion, N66 billion and 16.9 billion respectively despite the above reports; apprised of the anti-stamp duties collection stance of the Nigerian Inter-Bank Settlement System (NIBSS),” Mr Enoh said.

“It is currently being accused of systemic diversion of huge revenue flows from stamp duties collection on the electronic transfer receipt on online bank transactions, and the necessity to demand notice on all unremitted stamp duties.

“The Senate is convinced of the duties and responsibilities of the National Assembly to ensure the harnessing of all sources of revenue to the government of the federation, and to curb all forms of wastefulness, corruption and diversion of funds belonging to the federation.”

The School of Banking Honours (SBH) is the consultancy agent authorised in October 2017 by the federal government, alongside the International Investment Law and Arbitration, to recover stamp duty revenue that has not been remitted.

It raised alarm in March that the NIBSS has been uncooperative so far in SBH’s efforts to recover unremitted stamp duty revenue of about $53.3 billion (N19.4 trillion) borne out of inter-bank electronic transactions.

According to Tola Adekoya, SBH’s Project Consultant and Chief Executive Officer, N7.719 trillion was due in 2015 as accumulated yet unremitted revenue to the federal and state governments of Nigeria. In total, he said, the funds are about N20 trillion, out of which not up to one per cent has been remitted appropriately.

He also said the presidency, through the office of the secretary to the government, has ordered the CBN to cooperate with SBH in implementing its mandate.

However, NIBSS has refused on multiple occasions to grant access to data of relevant inter-bank transactions that passed through its central switch.

“We served the demand notice because NIBSS is the agent of banks that handles their transactions,” Mr Adekoya said.

“Banks don’t have any power over NIBSS, once they ascertain a liability, they debit the banks immediately and that is why NIBSS is going to be a strategic partner in recovering the unremitted stamp duty revenue.

”It was indicated in the first paragraph of the letter sent to CBN and NIBSS that we should commence with NIBSS and that is what we are doing. We are following due process.

According to its website, the NIBSS, “was incorporated in 1993 and is owned by all licenced banks including the CBN.”

It manages inter-bank payments so as to remove bottlenecks characteristic of fund transfers and operates the Nigeria Automated Clearing System (NACS).

The NIBSS board, “is composed of the Deputy Governor (Operations) of the Central Bank of Nigeria as the Chairman, representatives of Banks as Directors, Executive Directors and the Managing Director/CEO, who heads Executive Management group of the organisation”.

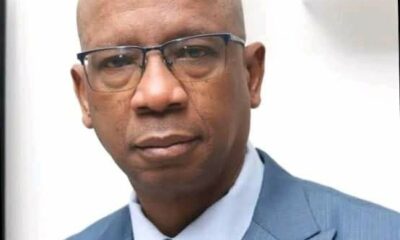

The House of Representatives Committee on Telecommunications, in October 2017, summoned Kemi Adeosun, the then finance minister; Godwin Emefiele, governor of the CBN, and Adebisi Adegbuyi, post-master general of NIPOST, to provide explanations on why billions generated from stamp duty charges were kept in commercial banks and the CBN.

Adebisi Adegbuyi, post-master general of NIPOST

The committee’s resolution was triggered by the revelations by Zhigun Usman, who is NIPOST’s Director of Finance and Investment, who said the sum of N13.4 billion had been deposited to the CBN by commercial banks.

Mr Usman had, however, added that the figure is ‘suspect’ as the banks’ remittances ”oddly increased geometrically after NIPOST announced plans to audit the accounts”.

FIRS, NIPOST: Fight For Relevance

The controversy as to who is responsible for what and the fate of revenue generated so far has been on for years.

In February 2016, the Revenue Mobilisation, Allocation and Fiscal Commission (RMAFC) had to wade in to strike an agreement between the competing forces on access to a revenue account estimated to attract over N2.5 trillion annually.

Moreover, in which authority the control of stamp duty funds resides has also been a contentious matter, especially between the FIRS and NIPOST. While FIRS has claimed stamp duties collection as part of its statutory functions, NIPOST appears to disagree.

Ike Odume, FIRS’s Director Legal Services, described a controversial bill to amend provisions of the Stamp Duties Act as an attempt to usurp its duties. According to him, the Act as it exists is a tax legislation which has nothing to do with NIPOST.

The postmaster-general of the federation, however, said, in his submission, that the amendment is crucial because the law has become old-fashioned and that NIPOST is only requesting for permission to sell stamps, either manually or electronically.

“We are seeking the amendment of the Act to include the sale of a postage stamp. We are not collecting the tax. It is in the interest of Nigeria to draw a line between duty and stamp. We want to sell our stamps,” Mr Adegbuyi said.

Between December 2016 and January 2017, NIPOST put out adverts for forensic auditors to peruse bank records in an attempt to confirm the compliance level of banks when it comes to remittances.

But, as gathered by Punch, the postal service had to ditch its plan after the CBN said it could use its supervisory powers to achieve similar results.

NIBSS Denies Responsibility

Samuel Oluyemi, NIBSS’ Deputy General Manager of Corporate Services, in an interview with TheCable said, despite claims to the contrary by the SBH, the NIBSS is not attempting to prevent the federal government from realising the full potentials of the Stamp Duties Act.

He explained this is because the company is neither in possession of any revenue accruing from stamp duties nor is aware of how much been collected under the scheme. NISS jurisdiction does not cover anything having to do with stamps or cheques, he added.

He also revealed that there is no mechanism presently in place to track how much each bank is collecting and that banks charge the duty ”at their own discretion” as not even all of them make the necessary deductions.

He recommended that the enabling act for the collection of stamp duty is reviewed to specify what should be collected.

Governors’ Forum Angle

When contacted by The ICIR, Abulrazaque Bello-Barkindo, who is the media and public affairs head at the Nigerian Governors’ Forum (NGF) Secretariat, insisted the forum cannot comment on the subject “at the moment because the case is subjudice”. He declined to shed light on what the litigation is about or who the parties are.

“There is post office interest, there is governors’ interest, so we are not talking about it until the case is adjudicated on,” he explained.

He was also asked whether a report has been submitted by the three-man committee established by the NGF, in April, and headed by Ibikunle Amosun, governor of Ogun state, which was mandated to investigate the allegations of non-remittance. ”No, they have not,” he replied.

“As a matter of fact, there has not been any meeting regarding that up till now. The governor has been very busy, and we have not had it on the agenda for the last four, five meetings.”

The committee had been given one week to submit its findings to the forum.

NGF’s concern regarding the unexplained non-remittance of the bulk of the duty arises as a result of the percentage guaranteed to flow to the thirty-six states.

With the current sharing formula, while the federal government takes the lion’s share of 52.68 per cent from the federation account, the state governments collectively get 26.72 per cent and the country’s 774 local governments get 20.6 per cent.

Adebisi Adegbuyi, Postmaster-General of NIPOST, did not answer calls from The ICIR and has not responded to texts asking, among other questions, if the postal office still intends conducting an independent audit of bank records.

Source: Premium Times.

Finance

Banks To Now Charge 0.5% Cybersecurity Levy As Directed By CBN; Netizens React

The Central Bank of Nigeria (CBN) has directed deposit money banks in the country to start charging 0.5% cybersecurity levy on some transactions done by their customers.

The apex bank gave the directive in a circular dated May 6, 2024 and sent to all commercial, merchant, non-interest and payment service banks as well as mobile money operators and payment service providers.

“Following the enactment of the Cybercrime (Prohibition, Prevention, etc) (amendment) Act 2024 and pursuant to the provision of Section 44 (2) (a) of the Act, ‘a levy of 0.5% (0.005) equivalent to a half percent of all electronic transactions value by the business specified in the Second Schedule of the Act’, is to be remitted to the National Cybersecurity Fund (NCF), which shall be administered by the Office of the National Security Adviser (ONSA),” the circular partly read.

The apex bank said that the implementation of the levy would start two weeks from the date of the circular.

“The levy shall be applied at the point of electronic transfer origination, then deducted and remitted by the financial institution. The deducted amount shall be reflected in the customer’s account with the narration, ‘Cybersecurity Levy’. Deductions shall commence within two weeks from the date of this circular for all financial institutions and the monthly remittance of the levies collected in bulk to the NCF account domiciled at the CBN by the fifth business day of every subsequent month,” the circular said

The apex bank added that this new levy will not be applied on transactions such as loan disbursements and repayments, salary payments, intra-account transfers within the same bank or between different banks for the same customer, intra-bank transfers between customers of the same bank.

Also exempted from the levy were inter-branch transfers within a bank, cheque clearing and settlements, Letters of Credits, Banks’ recapitalisation-related funding only bulk funds movement from collection accounts, savings and deposits including transactions involving long-term investments, among others.

This current implementation however is not sitting well with some netizens as they reacted to the new development.

Here were some of their reactions from X.

Finance

EFCC Chairman Tasks Nigerian Youths Against Crimes And Fraudulent Acts

The Chairman of Economic Finance Crime Commission (EFCC), Ola Olukoyede, has stressed the need for Nigerian Youth to see themselves as agents of positive change that have a lot to contribute to the socioeconomic development of the Nation.

Speaking at the 2nd edition of a Leadership Trainings Programme in Abuja, Olukoyede, who was represented by the Head Enlightenment and Re-orientation unit, (EFCC), Aisha Mohammed, said the commission’s dream is to see the youth contribute meaningfully to the society, emphasizing on the need to work together in bringing positive change to society.

The Economic and Financial Crimes Commission Boss declared the readiness of his agency to work with all Stakeholders, including the youth towards changing the narrative and reposition the country to greater exploit.

Also speaking, the representative of the Executive Secretary of Tertiary Education Trust Fund (TETFUND), Sonny Echono, appealed to the youths is to eschew social vices that could deter their full potential in life.

Other speakers at the event, including the Chairperson, Zero Tolerance for Social Immoralities Initiative (ZEITI) Africa, Rasak Jeje called on all stakeholders to join hands in collective pursuit of empowering new generation of leaders to curb the rising tides of social Vice among Nigerian youths.

The Chairperson, Zero Tolerance for Social Immoralities Initiative (ZEITI) Africa, Rasak Jeje made the call while addressing journalists at the 2nd edition of it Leadership Trainings Programme in Abuja on Thursday.

He said the training was aimed to intimate students leaders with knowledge and insights that will help them drive positive change and become exemplary leaders in their respective spheres.

Finance

AISA Has Refunded The Fees Paid By Yahaya Bello To EFCC

The Economic and Financial Crimes Commission (EFCC) says the American International School Abuja (AISA) has refunded the fees paid by the immediate past governor of Kogi state, Yahaya Bello, for his children attending the school.

In response to a letter addressed to the Lagos zonal commander of the EFCC, the school said $845,852 was paid in tuition “since the 7th of September 2021 to date”.

AISA said the sum to be refunded is $760,910 because it had deducted educational services already rendered.

“Please forward to us an official written request, with the authentic banking details of the EFCC, for the refund of the above-mentioned funds as previously indicated as part of your investigation into the alleged money laundering activities by the Bello family.

Since the 7th September 2021 to date, $845,852.84 (Eight Hundred and Forty-Five Thousand, Eight Hundred and Fifty Two US Dollars and eighty four cents) in tuition and other fees has been deposited into our Bank account.

We have calculated the net amount to be transferred and refunded to the State, after deducting the educational services rendered as $760,910.84. (Seven Hundred and Sixty Thousand, Nine Hundred and Ten US Dollars and Eighty Four cents).

No further additional fees are expected in respect of tuition as the students’ fees have now been settled until they graduate from ASIA.”

In a chat with The Cable, the spokesperson of the EFCC, Dele Oyewale, confirmed that the school has refunded the money.

‘’The money has been paid into public account,” Dele Oyewale was quoted as saying

-

News24 hours ago

News24 hours ago“80% Of Buildings In Lekki Have No Approval” – Lagos State Commissioner For Physical Planning & Urban Development Reveals

-

News5 days ago

News5 days agoIPOB Declares May 30th As Sit-at-home Day Across The Southern East States To Honour Biafran Fallen Heroes

-

Education4 days ago

Education4 days agoFederal Government Sets To Commence School-To-Work Scheme

-

News3 days ago

News3 days agoLady Dies After Friends Pushed Her Into Boiling Pot Of Fresh Pepper In Delta State

-

Finance3 days ago

Finance3 days agoEFCC Chairman Tasks Nigerian Youths Against Crimes And Fraudulent Acts

-

Entertainment1 day ago

Entertainment1 day agoCelebrities Turn Up For The Dedication Of Ali Baba’s Triplets In Lagos

-

TechNews21 hours ago

TechNews21 hours agoSIM Boxing, And The Unboxing of a Crime Syndicate

-

GRTech2 hours ago

GRTech2 hours agoSHELT SI Achieves Cisco Select Partner Certification