Finance

Will the Central Bank of Nigeria cut interest rates in November?

By Lukman Otunuga

Rising inflationary pressures in Nigeria will certainly complicate the Central Bank of Nigeria’s efforts to cut interest rates to stimulate growth.

The nation’s annual inflation edged up to 11.24% in September 2019, its highest level in three months after falling to a three-and-a-half-year low of 11.02% in August.

Given how the CBN governor has already made it clear that inflation must hit single digits before a rate cut could be considered, it remains uncertain whether the central bank will cut interest rates before year end.

A rate cut could inject the Nigerian economy with a welcome boost, as it stimulates consumption which accounts for roughly 80% of GDP. But However, cutting the MPR when the inflation rate is at 11.22 percent risks further overheating prices. Like other economies, Nigeria may be exposed to the impacts of a global slowdown but its economy is very different from the US’ which is currently experiencing anemic price inflation. This may be why the Central Bank of Nigeria decided to prioritize reducing inflation to single digits and said it is in no hurry to reduce its key rate.

In the absence of cutting interest rates, the CBN has raised the country’s loan to deposit ratio for banks to 65% from 60%. Making sure money is in circulation instead of being tied up in government bonds sounds like a logical way to keep the economy on the road to recovery. However, it remains to be seen whether this will be enough to promote growth.

Trade hopes lift risk mood; Brexit drama continues

There is a mood of optimism and hope across financial markets on Tuesday morning thanks to upbeat comments from President Donald Trump regarding the progress of trade talks with China.

Given how the President said China has signaled that negotiations over the initial trade deal are moving in the right direction, expectations remain elevated over both sides signing an agreement at a meeting in Chile next week. This positive sentiment is supporting Asian stocks during early trading and is likely to trickle down to European markets later this morning. While the encouraging mood across financial markets will remain stimulated by trade optimism, risk aversion could still make an abrupt return should talks drag on or turn sour.

Pound volatility expected as Brexit drama continues

The past few days have been volatile for the British Pound due to ongoing uncertainty and constant drama revolving around Brexit.

Sterling seems to be catching its breath early this morning as MP’s prepare to vote on Boris Johnson’s Withdrawal Agreement Bill later this afternoon. If the deal hits a brick wall, the ball then gets hurled back to Brussels as we await confirmation of the Government’s Brexit extension request. Should MPs back the Prime Ministers deal, a programme of motion will take place shortly after, followed by a debate on amendments of the bill on Wednesday. Regardless of what happens today, the British Pound is set to remain volatile.

With regards to the technical picture, GBPUSD has broken above the bearish channel on the weekly timeframe. A solid daily close above 1.30 should inspire a move towards 1.3160 in the medium term. Should 1.30 prove to be a stubborn resistance level, I see Sterling declining back towards the 1.2700 support.

Dollar Index poised for further declines?

There has not been much action in the Dollar Index (DXY) since the start of the week with prices trading around 97.76 as of writing.

The heavy selloff witnessed last week has placed bears in a position of power. The DXY is under pressure on the daily charts with prices trading under the 200 Simple Moving Average. Sustained weakness below the 97.50 level should encourage a decline back towards 97.00 in the short to medium term.

Commodity spotlight – Gold

Gold is likely to remain on standby in the absence of a fresh directional catalyst.

The precious metal is waiting for the next big theme or market-moving event that will influence global sentiment and risk appetite. Until something fresh is brought into the picture, Gold is positioned to trade within a modest range in the short to medium term.

Looking at the technicals, all eyes will remain on the psychological $1500 level. Sustained weakness below this point should inspire a decline towards $1470. Alternatively, a solid breakout above $1500 will most likely open the doors towards $1515 and $1525, respectively.

Finance

Banks To Now Charge 0.5% Cybersecurity Levy As Directed By CBN; Netizens React

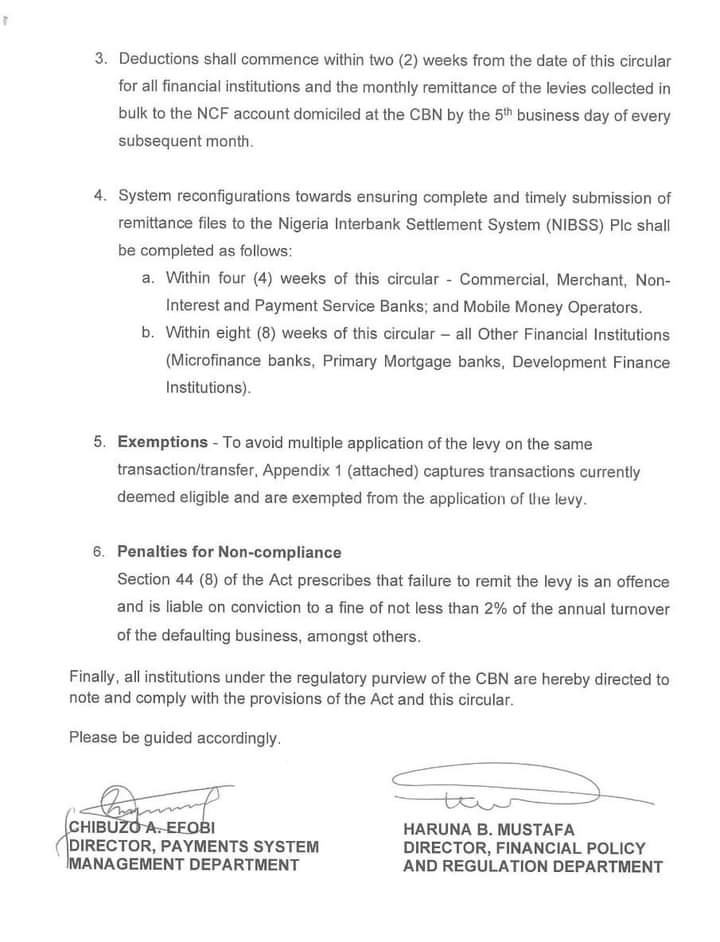

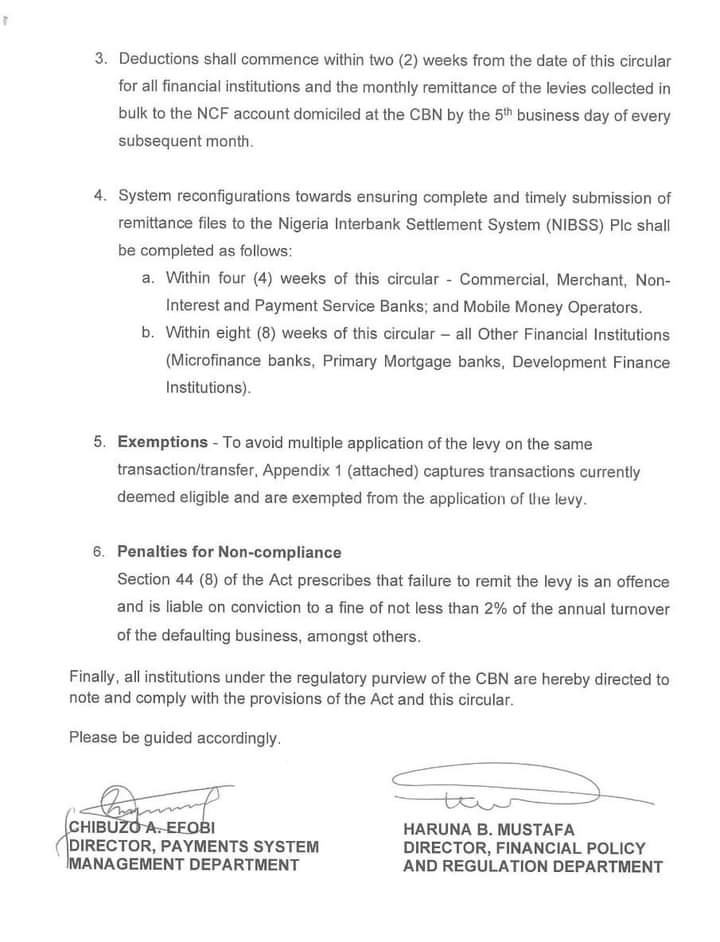

The Central Bank of Nigeria (CBN) has directed deposit money banks in the country to start charging 0.5% cybersecurity levy on some transactions done by their customers.

The apex bank gave the directive in a circular dated May 6, 2024 and sent to all commercial, merchant, non-interest and payment service banks as well as mobile money operators and payment service providers.

“Following the enactment of the Cybercrime (Prohibition, Prevention, etc) (amendment) Act 2024 and pursuant to the provision of Section 44 (2) (a) of the Act, ‘a levy of 0.5% (0.005) equivalent to a half percent of all electronic transactions value by the business specified in the Second Schedule of the Act’, is to be remitted to the National Cybersecurity Fund (NCF), which shall be administered by the Office of the National Security Adviser (ONSA),” the circular partly read.

The apex bank said that the implementation of the levy would start two weeks from the date of the circular.

“The levy shall be applied at the point of electronic transfer origination, then deducted and remitted by the financial institution. The deducted amount shall be reflected in the customer’s account with the narration, ‘Cybersecurity Levy’. Deductions shall commence within two weeks from the date of this circular for all financial institutions and the monthly remittance of the levies collected in bulk to the NCF account domiciled at the CBN by the fifth business day of every subsequent month,” the circular said

The apex bank added that this new levy will not be applied on transactions such as loan disbursements and repayments, salary payments, intra-account transfers within the same bank or between different banks for the same customer, intra-bank transfers between customers of the same bank.

Also exempted from the levy were inter-branch transfers within a bank, cheque clearing and settlements, Letters of Credits, Banks’ recapitalisation-related funding only bulk funds movement from collection accounts, savings and deposits including transactions involving long-term investments, among others.

This current implementation however is not sitting well with some netizens as they reacted to the new development.

Here were some of their reactions from X.

Finance

EFCC Chairman Tasks Nigerian Youths Against Crimes And Fraudulent Acts

The Chairman of Economic Finance Crime Commission (EFCC), Ola Olukoyede, has stressed the need for Nigerian Youth to see themselves as agents of positive change that have a lot to contribute to the socioeconomic development of the Nation.

Speaking at the 2nd edition of a Leadership Trainings Programme in Abuja, Olukoyede, who was represented by the Head Enlightenment and Re-orientation unit, (EFCC), Aisha Mohammed, said the commission’s dream is to see the youth contribute meaningfully to the society, emphasizing on the need to work together in bringing positive change to society.

The Economic and Financial Crimes Commission Boss declared the readiness of his agency to work with all Stakeholders, including the youth towards changing the narrative and reposition the country to greater exploit.

Also speaking, the representative of the Executive Secretary of Tertiary Education Trust Fund (TETFUND), Sonny Echono, appealed to the youths is to eschew social vices that could deter their full potential in life.

Other speakers at the event, including the Chairperson, Zero Tolerance for Social Immoralities Initiative (ZEITI) Africa, Rasak Jeje called on all stakeholders to join hands in collective pursuit of empowering new generation of leaders to curb the rising tides of social Vice among Nigerian youths.

The Chairperson, Zero Tolerance for Social Immoralities Initiative (ZEITI) Africa, Rasak Jeje made the call while addressing journalists at the 2nd edition of it Leadership Trainings Programme in Abuja on Thursday.

He said the training was aimed to intimate students leaders with knowledge and insights that will help them drive positive change and become exemplary leaders in their respective spheres.

Finance

AISA Has Refunded The Fees Paid By Yahaya Bello To EFCC

The Economic and Financial Crimes Commission (EFCC) says the American International School Abuja (AISA) has refunded the fees paid by the immediate past governor of Kogi state, Yahaya Bello, for his children attending the school.

In response to a letter addressed to the Lagos zonal commander of the EFCC, the school said $845,852 was paid in tuition “since the 7th of September 2021 to date”.

AISA said the sum to be refunded is $760,910 because it had deducted educational services already rendered.

“Please forward to us an official written request, with the authentic banking details of the EFCC, for the refund of the above-mentioned funds as previously indicated as part of your investigation into the alleged money laundering activities by the Bello family.

Since the 7th September 2021 to date, $845,852.84 (Eight Hundred and Forty-Five Thousand, Eight Hundred and Fifty Two US Dollars and eighty four cents) in tuition and other fees has been deposited into our Bank account.

We have calculated the net amount to be transferred and refunded to the State, after deducting the educational services rendered as $760,910.84. (Seven Hundred and Sixty Thousand, Nine Hundred and Ten US Dollars and Eighty Four cents).

No further additional fees are expected in respect of tuition as the students’ fees have now been settled until they graduate from ASIA.”

In a chat with The Cable, the spokesperson of the EFCC, Dele Oyewale, confirmed that the school has refunded the money.

‘’The money has been paid into public account,” Dele Oyewale was quoted as saying

-

Entertainment3 days ago

Entertainment3 days agoWhy I’m Not Ready For Kids – Singer Burna Boy Reveals

-

Politics5 days ago

Politics5 days agoPresident Tinubu Bans Purchase Of Petrol-dependent Vehicles By FEC Members

-

Entertainment4 days ago

Entertainment4 days agoMen Of The Lagos State Police Command Have Arrested Singer Portable

-

News5 days ago

News5 days agoMath Teacher Accused Of Having Sex With 2 Students And Getting Pregnant For One Tearfully Reveals The Baby Was Taken Away From Her

-

GROpinion3 days ago

GROpinion3 days agoExposing the Malicious Sabotage of MoMo PSB Project in Enugu Ezike

-

News3 days ago

News3 days agoThe Peruvian Government Has Officially Classified Transgender, Nonbinary And Intersex People As “Mentally ill”