Energy

Tinubu Speaks On Incessant National Grid Collapse

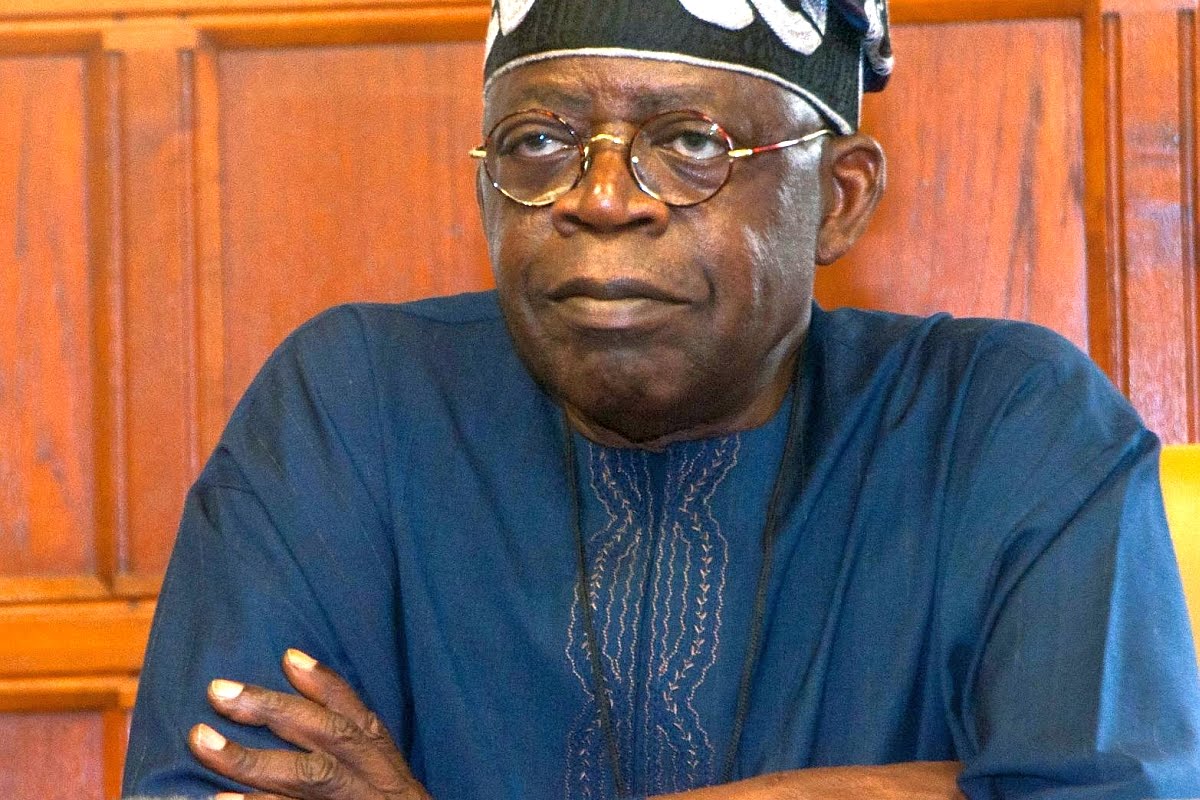

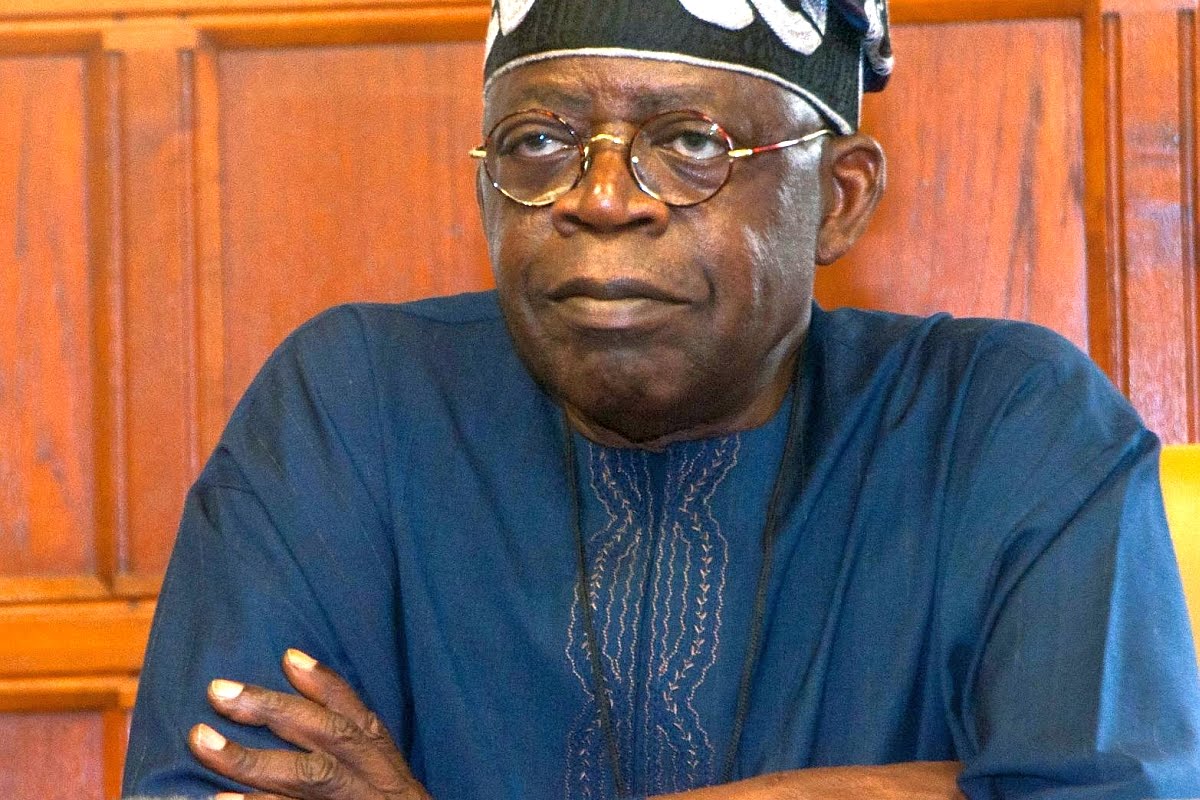

Presidential aspirant Bola Tinubu has blamed the incessant power failures assailing the country’s economy on the previous administration’s failure to heed his advice.

Mr Tinubu who made this revelation while speaking at a parley on Wednesday disclosed how he brought in major investors into the country.

The former governor boasted that he was the first governor to introduce the Independent Power Project in Nigeria.

“I am the first governor to bring Independent Power Project (IPP) to Nigeria. It was 300 megawatts. If they had followed my advice then, Nigeria will not be facing epileptic power supplies,” the former Lagos governor said.

Mr Tinubu, who has formally entered the presidential election race for 2023, hailed himself as the most qualified candidate, adding that his dream is for a country that is not a poverty index.

Nigeria’s power grid collapsed last Friday, the third time in less than four weeks.

In the wake of the latest grid collapse, Minister of Power Abubakar Aliyu on Saturday announced that an investigation had been launched into the recurring collapse.

On his part, works minister Tunde Fashola blamed unnamed vandals for the nationwide blackout reported after the national grid collapsed that occurred on Friday evening.

Energy

NNPC, Dangote Strengthen Strategic Partnership

Bot partners reaffirmed commitment to Healthy Competition Towards National Prosperity, reports SANDRA ANI

As part of ongoing efforts to promote mutually beneficial partnerships and foster healthy competition, the Nigerian National Petroleum Company Limited (NNPC Ltd.) and Dangote Petroleum Refinery & Petrochemicals (DPRP) have pledged to deepen collaboration aimed at ensuring Nigeria’s energy security and advancing shared prosperity for Nigerians.

This commitment was made during a courtesy visit by the President/Chief Executive of Dangote Group, Mr. Aliko Dangote, and his delegation to the Group CEO of NNPC Ltd., Mr. Bashir Bayo Ojulari, and members of the company’s Senior Management Team at the NNPC Towers, on Thursday.

During the visit, Dangote pledged to collaborate with the new NNPC Management to ensure energy security for Nigeria.

“There is no competition between us, we are not here to compete with NNPC Ltd. NNPC is part and parcel of our business and we are also part of NNPC. This is an era of co-operation between the two organizations.” Dangote added.

While congratulating the GCEO and the Senior Management Team on their “well-deserved appointments,” Dangote acknowledged the enormity of the responsibility ahead, noting that the GCEO is shouldering a monumental task, which he expressed confidence that, with the capable hands at his disposal in NNPC, the task is surmountable.

In his remarks, the GCEO, Mr. Bashir Bayo Ojulari assured Dangote of a mutually beneficial partnership anchored on healthy competition and productive collaboration.

Ojulari highlighted the exceptional caliber of talent he met in NNPC Ltd., describing the workforce as a dedicated, highly skilled and hardworking professionals who are consistently keen on delivering value for Nigeria.

Expressing the company’s readiness to build a legacy of national prosperity through innovation and shared purpose, Ojulari said NNPC will sustain its collaboration with the Dangote Group especially where there is commercial advantage for Nigeria.

Both executives also committed to being the relationship managers for their respective organisations through sustained productive collaboration and healthy competition, thereby envisioning limitless opportunities for both organizations.

Energy

AVEVA is providing data management support for renewable natural gas projects

Reporter: Godwin Ezeh

Key Highlights

● AVEVA’s industrial information infrastructure has been selected by Archaea Energy to provide key data management support

● AVEVA’s industrial software to optimize performance across Archaea’s RNG plants

AVEVA, a global leader in industrial software driving digital transformation and sustainability, has been selected by Archaea Energy, the largest renewable natural gas (RNG) producer in the US, to build a comprehensive operations data management infrastructure.

Using AVEVA’s software, Archaea Energy can collect, enrich and visualize its real-time operations data, enabling performance analysis across its growing network of plants.

Using AVEVA PI Data Infrastructure, a hybrid solution with cloud data services, the plants will be able to share data to highlight operational opportunities and optimize efficiency.

Caspar Herzberg, CEO, AVEVA, stated,

“Through this collaboration and the use of AVEVA PI Data Infrastructure, Archaea’s growing network of plants will have streamlined operations with accurate performance analysis throughout the expansion. AVEVA’s CONNECT software platform leverages industrial intelligence from a central location, making it easier to deploy additional digital solutions in the future.”

“As the largest RNG producer in the United States, we are dedicated to delivering reliable, clean energy,” said Starlee Sykes, chief executive officer of Archaea Energy. “This relationship will allow us to optimize operations and offer detailed performance analysis as we continue to expand across the country.”

Energy

Boost for Nigeria’s Oil Production, As NNPC’s Utapate Crude Grade Hits Global Oil Market

…OML 13 Asset Eyes 80,000 bpd by End of 2025

In a major boost for Nigeria’s crude oil production, revenue generation and economic growth efforts, the NNPC Ltd has officially unveiled its latest crude oil grade, the Utapate crude oil blend, before the international crude oil market.

It would be recalled that in July, 2024, NNPC Ltd and its partner, the Sterling Oil Exploration & Energy Production Company (SEEPCO) Ltd introduced the Utapate crude oil blend, following the lifting of first cargo of 950,000 barrels which headed for Spain.

During a ceremony held at the Argus European Crude Conference taking place in London, United Kingdom, on Wednesday, the Managing Director, NNPC E & P Limited (NEPL), Mr. Nicholas Foucart described the introduction of the Utapate crude oil blend into the market as a significant milestone for Nigeria’s crude oil export to the global energy market.

“Since we started producing the Utapate Field in May 2024, we have rapidly ramped up production to 40,000 barrels per day (bpd) with minimum downtime. So far, we have exported five cargoes, largely to Spain and the East Coast of the United States; while two more additional cargoes have been secured for November and December 2024, representing a significant boost to Nigeria’s crude oil export to the global market,” Foucart told a packed audience of European crude oil marketers.

He added that since its introduction into the global market, the Utapate crude oil blend has enjoyed a positive response from the international crude oil market, due to its highly attractive qualities.

Foucart said the Oil Mining Lease (OML) 13, fully operated by NEPL and Natural Oilfield Services Ltd (NOSL), a subsidiary of SEEPCO Ltd, boasts a huge reserves of 330million barrels of crude oil reserves, 45 million barrels of condensate and 3.5 tcf of gas.

“We have a number of ongoing projects to increase our production from the current 40,000bopd to 50,000bopd by January 2025 and 60,000bopd to 65,000bopd by June 2025. Essentially, we are targeting opportunities to increase production to 80,000bopd by the end of 2025,” Foucart added.

He said the Utapate crude oil terminal is sustainable, affordable and fully compliant with the rigorous environmental regulations and sustainability principles especially those aimed at reducing carbon emissions and other ecological effects.

Also speaking, the Managing Director of NNPC Trading Ltd (NTL), Mr. Lawal Sade said the pricing structure of the Utapate crude oil blend is similar to that of Amenam crude as it is a light sweet crude which is highly sought after by refiners across the world due to its low sulphur content, efficient yield of high-value products, API gravity and other similarities.

He said in bringing the new crude oil blend to the global market, NNPC Ltd wanted to optimise value for both its producers and counterparties across the globe.

He added to ensure predictability and sustainability of supply, the NNPC Trading intends to run a term contract on the Utapate crude oil blend cargoes, principally targeting off-takers from the European and the US East Coast refineries.

Produced from the Utapate field in OML 13 in Akwa Ibom State in Nigeria, the Utapate crude oil blend is similar to the Nembe crude oil grade. It has a low sulphur content of 0.0655% and low carbon footprint due to flare gas elimination, fitting perfectly into the required specification of major buyers in Europe.

The NNPC E&P Ltd and NOSL partnership is also committed to operating in a manner that is safe, environmentally responsible, and beneficial to the local communities.

The Utapate field development plan, executed between 2013-2019 and approved in October, included converting wells and facilities from swamp/marine to land-based operations.

The plan involved a multi-rig drilling campaign for 40 wells and the development of significant infrastructure such as production facilities, storage tank, a subsea pipeline and an offshore loading platform to facilitate crude oil evacuation and loading.

The entry of the Utapate crude oil blend into the market is coming barely a year after the NNPC Ltd announced the launch of Nembe crude oil, produced by the NNPC/Aiteo operated Oil Mining Lease (OML) 29 Joint Venture (JV).

This remarkable achievement signals the commitment of the NNPC Ltd to increasing Nigeria’s crude oil production and growing its reserves through the development of new assets.