Energy

Oil prices crash

… OPEC raises production target from July

Crude oil prices fell yesterday after the decision by the Organisation of the Petroleum Exporting Countries (OPEC) and non-OPEC members to raise crude supplies to about one million barrels by starting from July 1.

The move was aimed at compensating producers for production loss at a time of rising global consumption.

What this means is that any country with spare capacity will be able to boost production.

Nigeria was originally exempted from the initial output capping due to the volatility in the Niger-Delta, which brought the country’s crude oil down to less than one million barrel per day.

OPEC and non-OPEC removed about 1.8 million (bpd) from the market to boost crude oil prices.

Though crude oil prices witnessed a little increase on Friday while the OPEC meeting was going on, but international benchmark for oil prices – Brent crude crashed from $75.32 a barrel to $74.44 per barrel.

But West Texas Intermediate (WTI) went down by 0.3 per cent to settle at $68.40 a barrel.

Nigeria’s Bonny Light crude oil also increased from $73.04 a barrel to $74.60 per barrel during the trading hours on Monday.

OPEC ministers at the 4th OPEC and non-OPEC Ministerial Meeting held in Vienna, Austria at the weekend, decided that countries will strive to adhere to the overall conformity level, voluntarily adjusted to 100 per cent, as of 1 July 2018 for the remaining duration of the ‘Declaration of Cooperation’ (DOC) and for the JMMC to monitor the overall conformity level and report back to the OPEC and non-OPEC Ministerial Meeting.

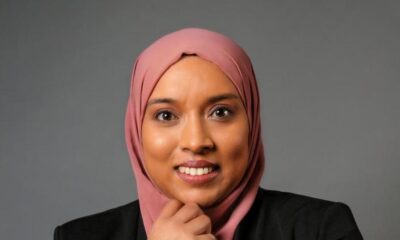

Commenting on the crude oil market, the Executive Chairman, Arrowville Energy Limited, Abiola Sowole, said that crude oil prices are determined by supply and demand.

According to her, if there is any unplanned disruption in the supply chain, due to geo-politics or other factors, the price will rise rapidly. “Nobody can tell how sustainable high prices are. There are several forecasts, however, of continuous rise in prices.

“One prediction is that they will rise to $75 a barrel this year, reaching $80-$85 next year and hitting $100 or higher by 2020, if the International Monetary Fund’s projection of a growing robust economy materializes and if there is a fast-growing global demand for oil. Another prediction is that oil prices will jump to $140 a barrel, due to U.S. sanctions against Iran and Venezuela, unless OPEC and Russia agree to reverse the oil production cuts they agreed to in 2016,” she added.

Speaking on the decision by OPEC, the United Arab Emirates (UAE) Minister of Energy and Industry, Suhail Mohamed Al Mazrouei, stated: “As we all know, in an increasingly interdependent world, with the oil industry a central element of this, the challenges we face can be complex. They need to be monitored on a regular basis, so that swift and informed decisions can be taken.

“It once again reinforces the importance of working in unison. It is vital that our hard-earned improvements are not compromised or lost.

“We need to keep in mind that it took all of us together to bring the oil market out of the wilderness, and we need to take these lessons into the future.”

He noted that the market has also continued to see the firm and unwavering resolve from OPEC and non-OPEC participants in the ‘Declaration of Cooperation’.

This, he said, is reflected in the unprecedented overall conformity levels that member countries have seen from participating countries.

OPEC Secretary General, Mohammad Sanusi Barkindo, said ‘Declaration of Cooperation’ literally rescued the oil industry from its worst ever downturn and now constitutes a fundamental and essential feature of the ‘new world of energy’.

According to him, over the last 18 months, this cooperation has helped return more balance to the oil market, more optimism to the industry and has had a positive impact on the global economy and trade worldwide.

He noted that it has enabled industry investment to gradually pick up, albeit not yet to pre-2014/15 levels, and has resulted in many jobs returning and unemployment easing.

Barkindo said that the importance of the Declaration has also received backing from other producers, as well as from consuming nations.

The Organisation has ably demonstrated its credentials as a body committed to international cooperation, working with other producers, honouring its commitments and promoting mutual respect among all nations.

He stated: “The Declaration underscores what can be accomplished through a constructive, continuous and fully committed approach to helping achieve a sustainable oil market stability.

“However, we appreciate that our work never stops! We are fully committed to sustaining balance and stability in the market, in the interests of both producers and consumers.

“In the coming months, we will look to institutionalise this long-term framework for continuity with an all-inclusive and broad-based participation, to look at some of the industry’s pertinent challenges, as well as the opportunities.”

Biafra: Court mandates Abaribe, others to produce Nnamdi Kanu today or go to jail

Justice Binta Nyako of the Abuja chapter of the Federal High Court has ordered Senator Enyinaya Abaribe and two others to produce leader of the Indigenous People of Biafra, IPOB, in court on Tuesday, or risk jail terms. *Guardian.ng

-

Education3 days ago

Education3 days agoEducation Priorities to Help Young People Shape Africa’s Future

-

Education3 days ago

Education3 days agoDigital Transformation Expert Rock Adote Joins Madonna University Board of Trustees

-

Health3 days ago

Health3 days agoHealthcare Under Attack: Why Cybersecurity is Now Critical Care

-

Health2 days ago

Health2 days agoCustos Care Foundation Reaches Thousands of Women, Girls with Free Medical Outreach